Leveraging Predictive Accounting for Sales Orders in SAP S/4HANA

Joseph Muroki, Principal, Global Practices, DiSC Execution, Bristlecone

There’s been a transformation of finance departments’ focus – from pure transactional processing and after-the-fact reporting, to delivering real-time insights and analysis and supporting business strategy through predictive and prescriptive analytics. SAP S/4HANA supports this transformation through highly automated processes, robotics and machine learning applications that help predict outcomes.

This enables a shift from period-end reporting to reporting at the moment of transaction (continuous close), delivering real-time insights without having to wait for a hard close. Beyond the continuous close, forward-looking finance departments focus on predictive close, providing predictions of financial metrics that are essential to detect variances from former expectations, and creating timely alerts to allow the business to respond to new market conditions early, rather than after the facts have materialized in the books.

What is Predictive Accounting for Sales Orders?

Predictive Accounting helps businesses create accurate, detailed, comprehensive and reconciled projections of future outcomes. It’s based on information already available in the logistic modules, such as sales orders, purchase orders and production orders, among others. It analyzes transactional line item information from these modules and determines the respective future economic effects.

SAP Predictive Accounting for sales orders provides an overview of sales orders and their values regardless of billing status. Incoming sales orders are translated into predictive revenue.

Typical Business Scenario

Normally, when a sales order is created, no financial postings are recorded in accounting until goods are issued and billings are posted. Until that occurs, there is no visibility into the expected revenue from these sales orders – and how it impacts future cashflow and working capital. Business must wait for period close to get insight into the planned and actual results, leading to after-the-fact reactions to business and market changes.

Key Business Drivers

The key business drivers for implementing Predictive Accounting include:

- Working Capital Predictions – Predictive Accounting gives businesses visibility into predicted revenues and expected expenditures

- Soft Close – Businesses no longer need to wait for hard close of the General Ledger for reporting and margin analysis

- Proactive Management of Business Changes – Businesses can proactively identify exceptions and opportunities and react accordingly

- Informed Decision-Making – Predictive Accounting relies on timely, objective and verifiable numbers derived from process mapping to project future financial performance

- Reuse of Predictive Accounting Data – All CDS-based financial accounting reports can make use of predictive journal entries in their KPI reporting

How it Works

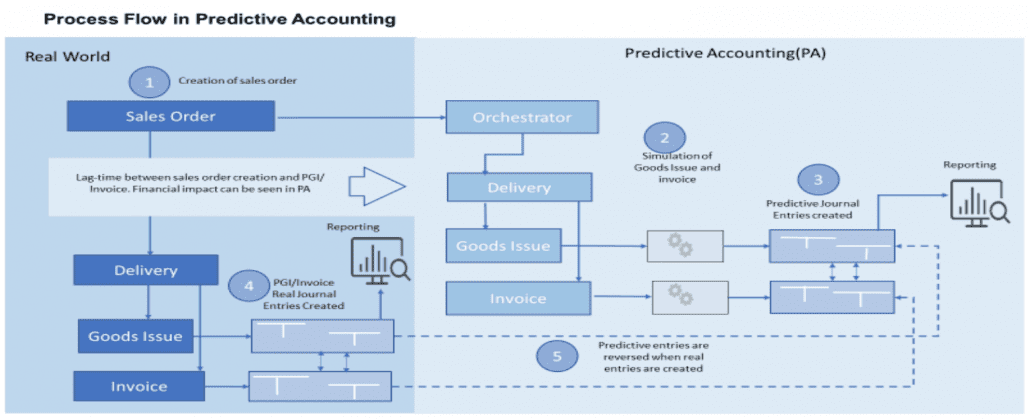

When a sales order is created, Predictive Accounting simulates all the necessary steps (goods issue / invoice documents) that are performed when the sales order is fulfilled and billed. It posts the simulated accounting impact to an extension ledger (non-GAAP ledger), separate from the standard accounting entries (GAAP-relevant ledger). To avoid duplicate entries, these journal entries are automatically reversed when actual goods issue and invoices are posted.

The dates for the predictive postings are based on confirmed quantities on the sales order or the billing schedule. The system translates expected revenue and costs from the sales orders to financial postings at the lowest granularity possible – financial line items, with audit trail to source documents. Prediction postings are made only for sales orders that have already been created within logistics modules.

Process Flow

Reporting

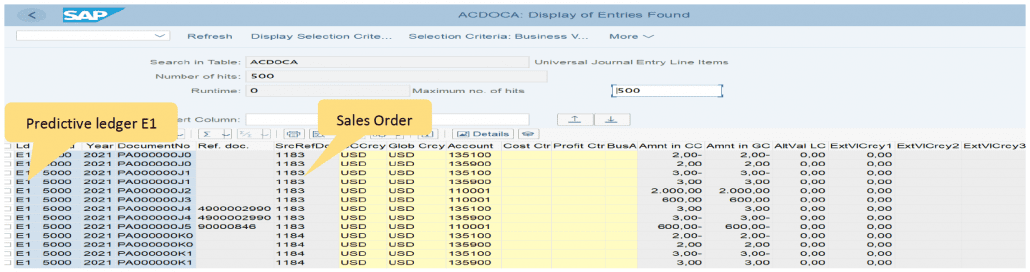

All Predictive Accounting postings are recorded in the extension ledger and stored in table ACDOCA, to enable any report query or app to report on this data.

There are some notable apps that are used in Predictive Accounting reporting, as shown below.

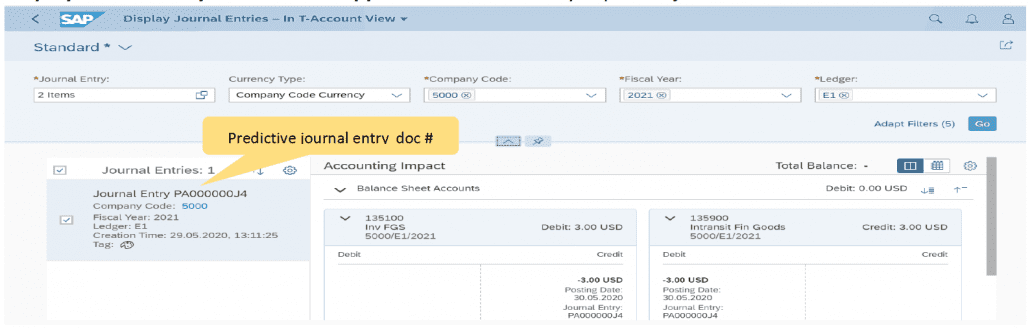

Display Journal Entry in T-Account App can be used to analyze posted journal entries.

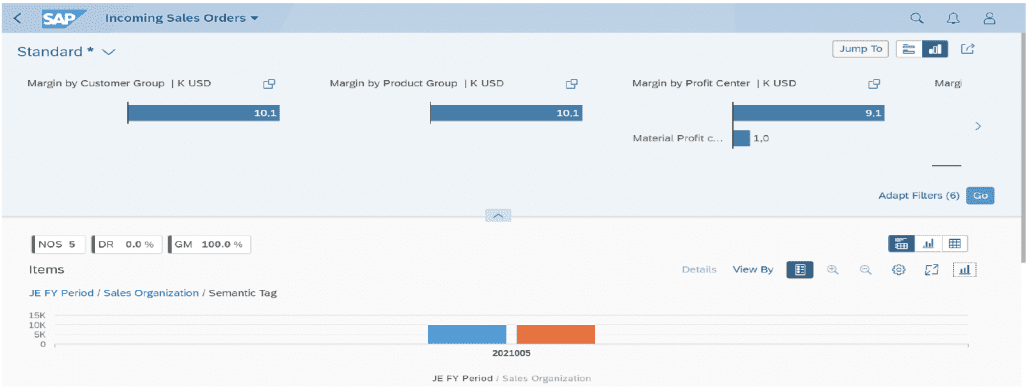

Incoming Sales Orders App can be used to analyze sales orders in different dimensions – e.g., material, customer, profit center, etc.

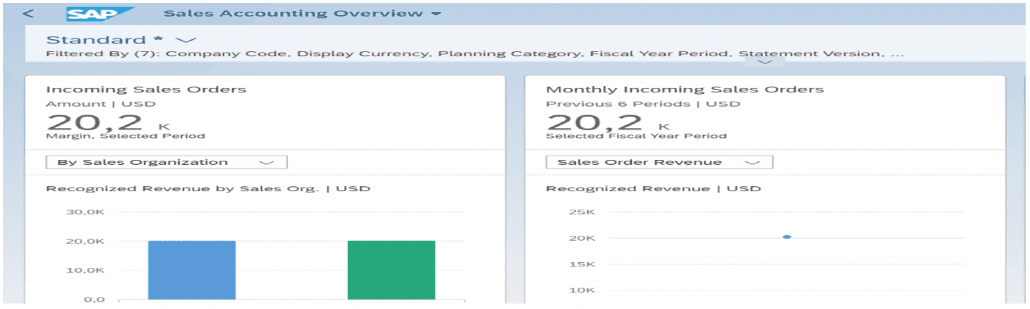

Sales Accounting Overview App allows combining data from the leading ledger and the prediction ledger to analyze the incoming sales order impact even if there are no actual goods issued or billing.

Predictive Accounting is a rather new and emerging component of financial accounting. It is included (at no additional cost) in the regular SAP S/4HANA license fee for on-premise and cloud deployments.

The current scope for Predictive Accounting covers selected sales scenarios. At present, it is best suited for companies with primarily short-term sales cycles, such as consumer products and component manufacturing. Scenarios for purchasing processes are expected to be covered in future releases.

Learn More